In the long term the united states fed funds rate is projected to trend around 100 percent in 2021 and 125 percent in 2022 according to our econometric models. There were times in history when the nations benchmark interest rate was well above this sweet spot to curb runaway inflation.

Are Interest Rates Going Up Or Down Trump Pushing Fed To Cut To Zero

The federal funds rate is an important benchmark in financial markets.

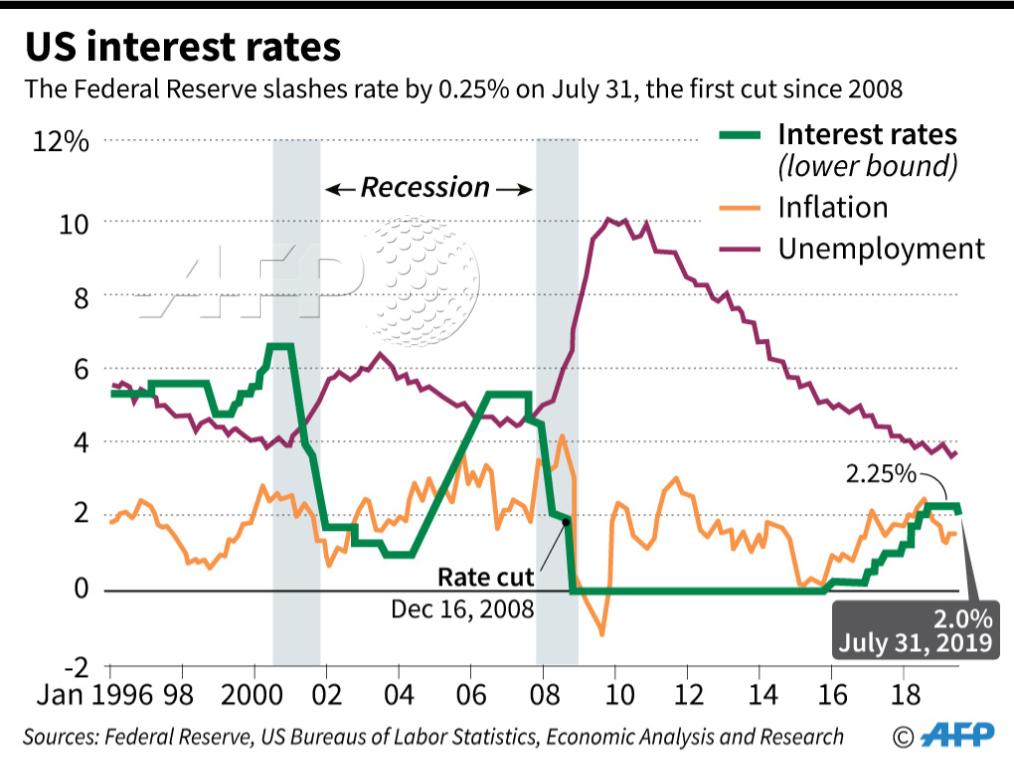

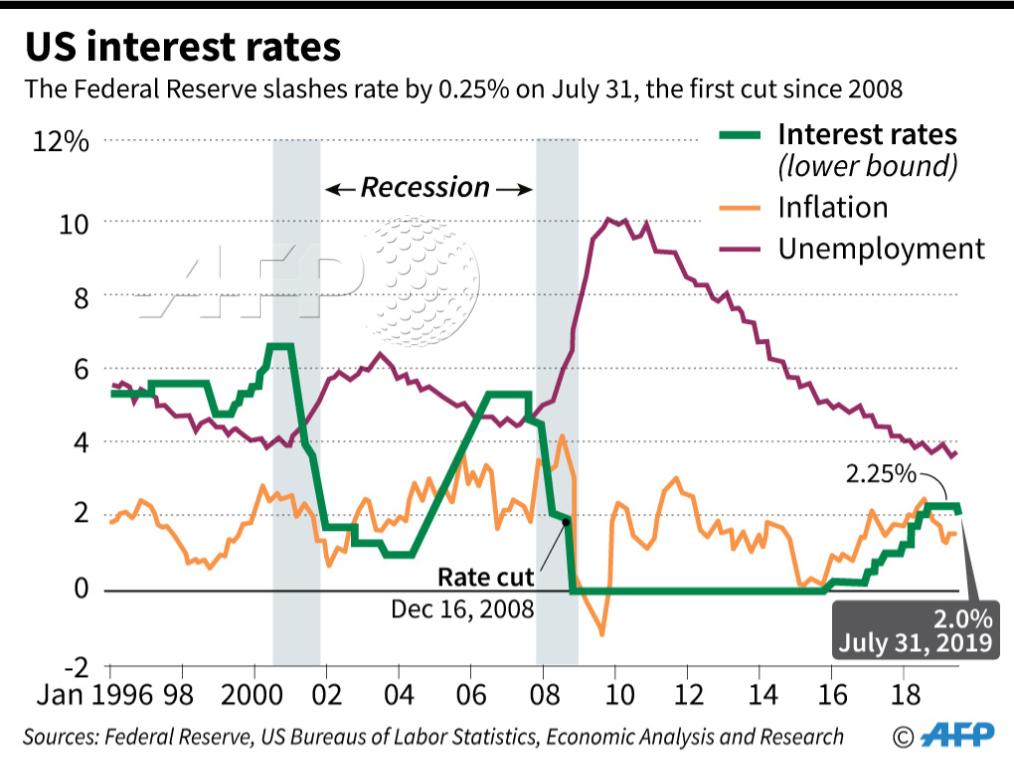

Federal benchmark interest rate. It is the rate at which american banks lend to each other in dollars. It was the second time the fed cut rates in 2019 in an attempt to keep the economic. The median forecast of members of the feds rate setting federal open market committee fomc puts the benchmark at 31 per cent at the end of 2019 up from the previous 29 per cent which signals four hikes next year rather than three.

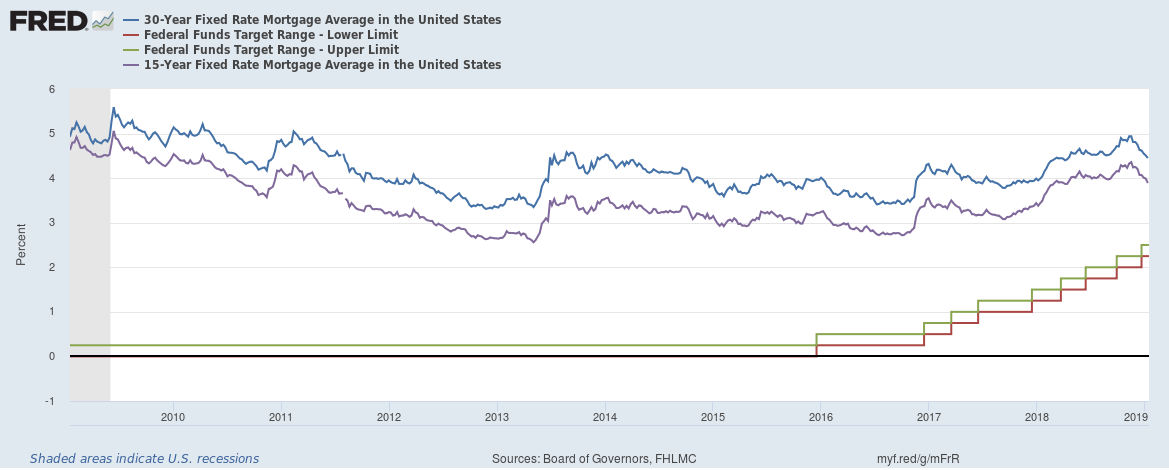

The federal fund rate plus 025 percent for example would be the interest rate on a loan to a large company. The federal reserve is the central bank of the united states and it is mandated by congress to promote economic stability mainly by raising or lowering the cost of borrowing. Between 2008 and 2015 it was well below the target to stimulate economic growth.

The federal funds rate is a benchmark interest rate. The interest rate that the borrowing bank pays to the lending bank to borrow the funds is negotiated between the two banks and the weighted average of this rate across all such transactions is the federal funds effective rate. On september 18 2019 the federal reserve cut the target range for its benchmark interest rate by 025.

It generally reflects the health of the economy and has a big impact on other interest rates. The federal reserve on wednesday raised its benchmark interest rate a quarter point but lowered its projections for future hikes. Once you see how the fed changed the fed funds rate you will understand how it managed both inflation and recession.

The federal funds rate is one of the most important interest rates in the us. As markets had expected the central bank took the target range. Many other interest rates are calculated from it.

Economy since it affects monetary and financial conditions which in turn have a bearing on critical aspects of the. About federal funds target rate upper bound a target interest rate set by the central bank in its efforts to influence short term interest rates as part of its monetary policy strategy. The federal funds rate is the benchmark interest rate banks charge each other for overnight loans.

Looking forward we estimate interest rate in the united states to stand at 050 in 12 months time.

Federal Reserve Predicts No Interest Rate Cuts In 2020 Ignoring

Afp News Agency On Twitter Infographic Us Federal Interest

History Of Fed Interest Rates Chart Catan Vtngcf Org

Us Federal Reserve Cuts Benchmark Interest Rate By 0 5

Fed Keeps Key Rate Unchanged While Signaling Future Hikes

Fed Raises Rates Amid Signs Of Strengthening Economy The

Rising Benchmark Interest Rates In The United States Are Having

Us Fed To Cut Rates Again As Optimism Is Tested

Federal Reserve Policy Makers Open To Trimming Benchmark Rates

No comments:

Post a Comment